Welcome to GoldTrain.com

This website is dedicated to covering topics related to precious metals, like Gold and Silver. Why does GoldTrain.com exist? Because with the current global economic uncertainty, many top fund managers are feeding the public bad information about gold and silver. They say it doesn’t have any intrinsic value. In fact, any knowledgeable (unbiased) investor knows these precious metals have significant intrinsic value. For thousands of years Gold and Silver have been the currencies that have held their true value and withstood the test of time, through good economic times, as well as through economic turmoil.

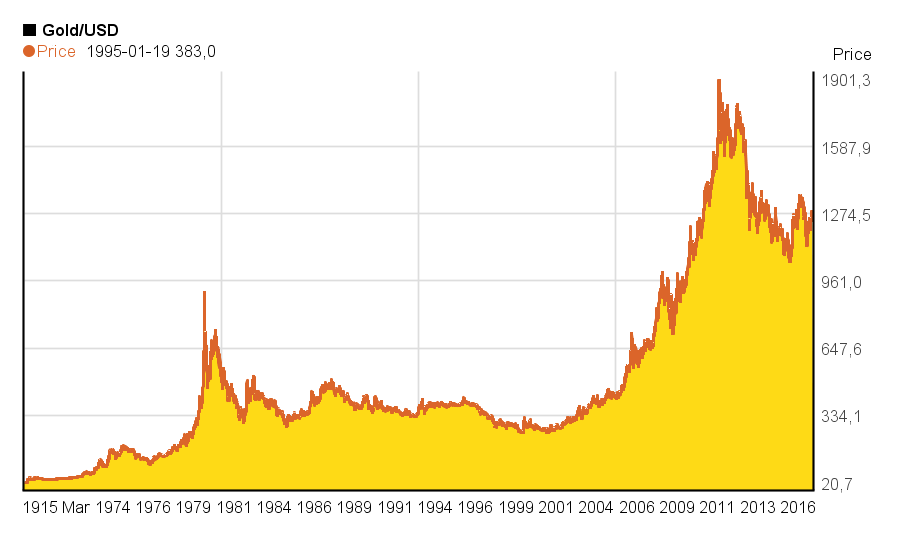

A money source that does lose intrinsic value is paper currency, especially the dollar. In the last 75 years, paper currencies have kept losing their value, while gold’s value has kept increasing over time. An example: In 1999, the price for an ounce of gold was about $300.00. Today, as of Sept. 2017, the price of an ounce gold is around $1,300.00.

One could argue that if in 1999 someone invested $300.00 in paper money and collected interest from the bank, that person could have gained more money, assuming the economy stayed constant. But, in reality, the economy doesn’t stay constant. It has ups and downs, evidenced by the internet bubble pop in 2000, the global financial crash of 2008. There will likely be more volatility in the future, but hopefully not too soon.

Other hidden factors contributing to the dollar’s value decreasing, are when the Fed continues to print more money to fund oversea wars (IRAQ is one example), and to bail out big institutions that were Too-Big-To-Fail. For every dollar the Fed prints, each dollar you earn and put into your savings, loses value.

Although gold and silver do not yield much interest when compared to stocks and bonds, they still are the most reliable (true currency) to hedge against an uncertain or unstable economy, due to their real, intrinsic values. By that I don’t meant you should buy gold and silver instead of holding on to your money or invest in stocks, bonds, etc. I’m saying that precious metals like gold and silver have intrinsic value, and you should weigh your options carefully, and don’t believe everything fund managers tell you about the “none intrinsic value” of gold and silver.

The mission of GoldTrain.com is to share insightful content to help you make intelligent and informed decisions to avoid your wealth being robbed by the invisible hands of government policy, or by misleading information. If you like our point of view, please share our content on your social media pages. Thank you!